- Category:

FinTech, Mobile App, Education

- Software:

React Native, Firebase, Plaid API

- Service:

App Development

- Client:

University Alliance

- Date:

December 6, 2025

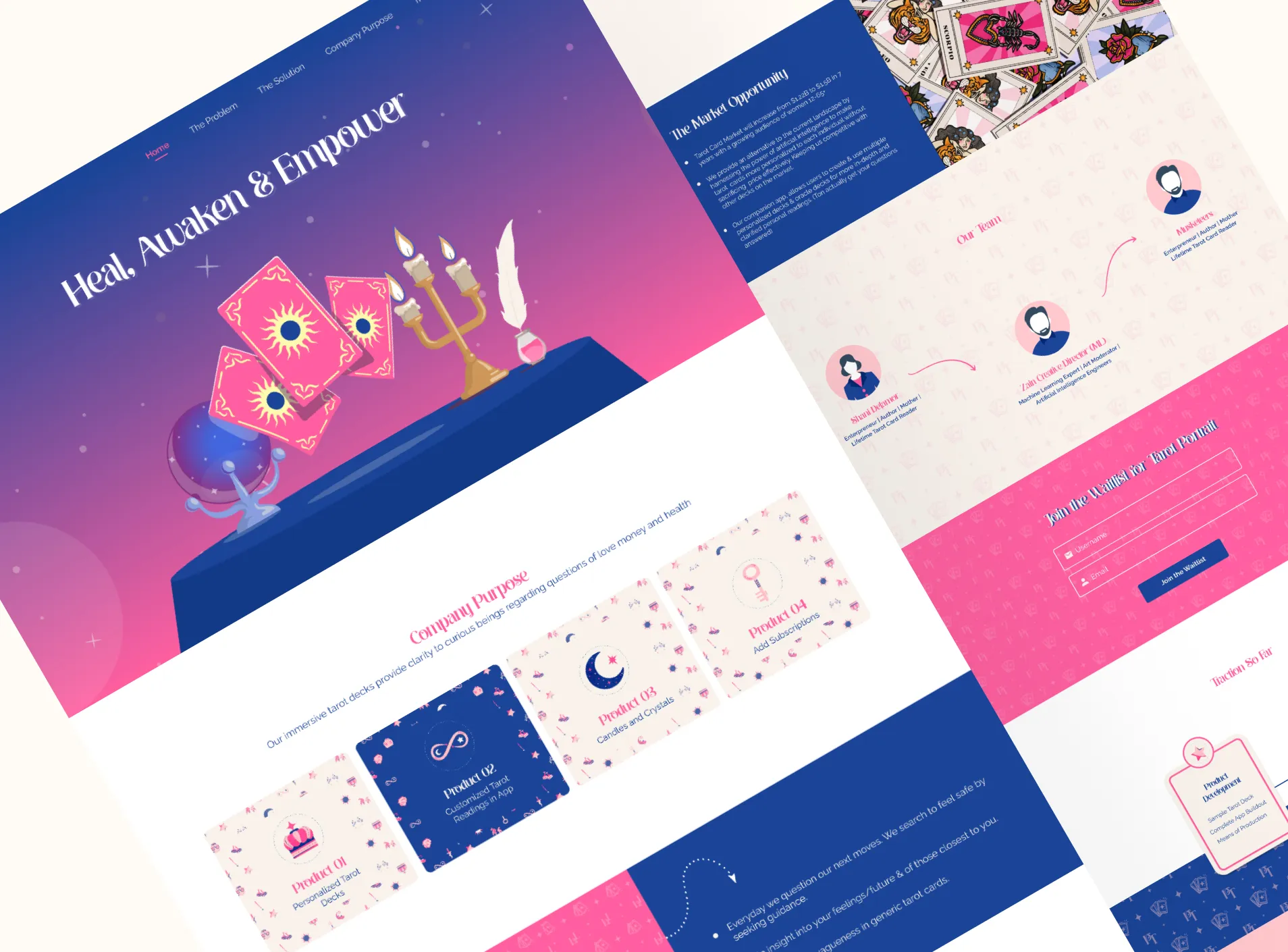

SmartBudget: Empowering Students with Financial Management

SmartBudget is a mobile-first financial literacy tool tailored specifically for the student demographic. It simplifies complex financial concepts into actionable insights, helping young adults manage tuition, rent, and daily expenses without the jargon found in traditional banking apps.

Financial Freedom Starts Here

For many students, college is their first time managing money independently. SmartBudget serves as a digital financial advisor, preventing debt accumulation and fostering lifelong money management skills.

Challenge & Solution

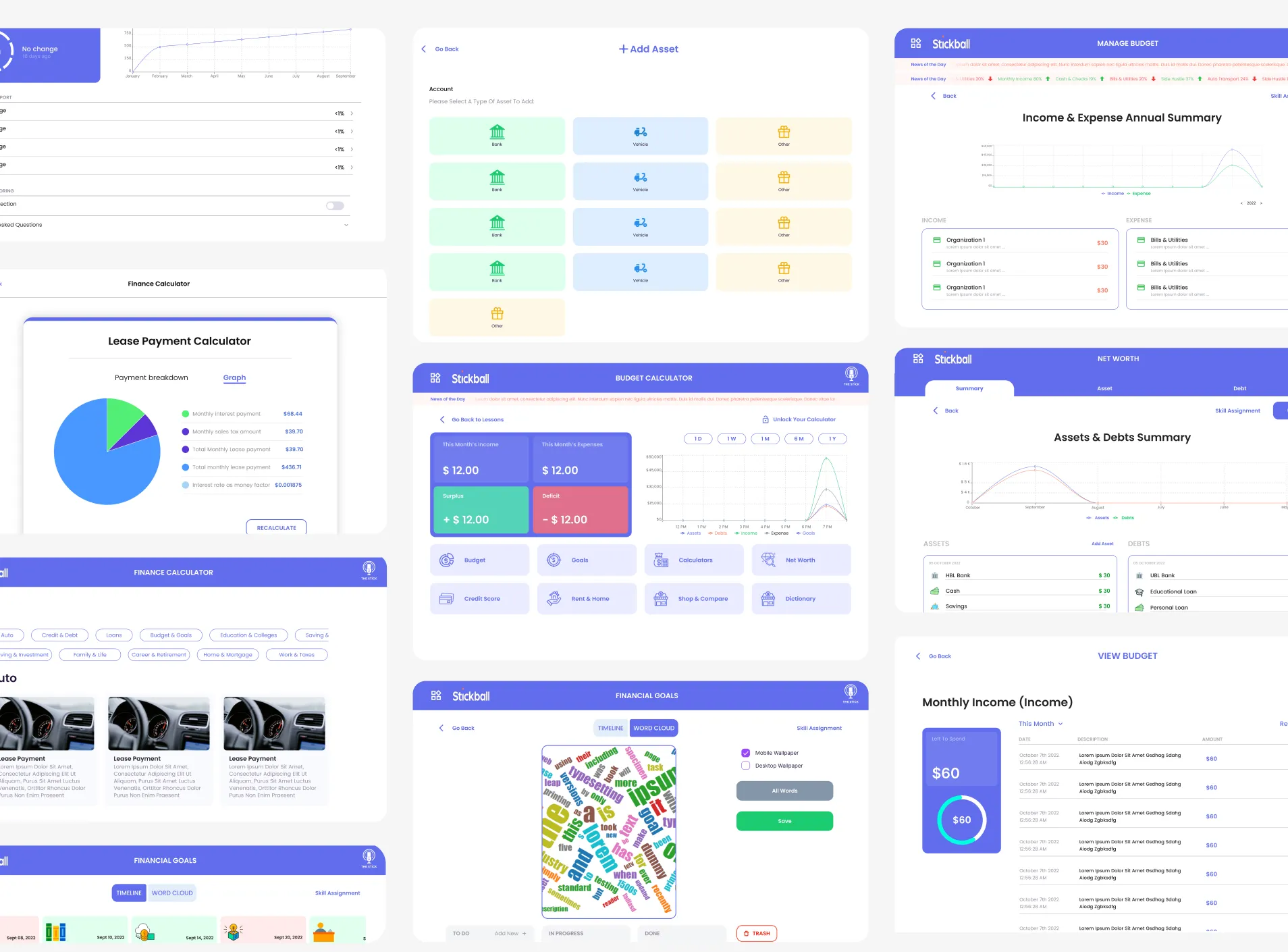

The Challenge: Students often struggle with budgeting due to irregular income streams (loans, part-time jobs, parental support) and unpredictable expenses (textbooks, social events). Standard budgeting apps are too rigid or expensive. There was a need for a free, gamified, and intuitive tool that could adapt to the unique “feast or famine” financial lifecycle of a student.

The Solution: We created SmartBudget, a gamified finance tracker.

Auto-Categorization

Using the Plaid API, the app securely connects to student bank accounts to automatically categorize transactions. It identifies “Needs” vs. “Wants” instantly, showing users exactly where their money is going.

Impact:

- Eliminates manual data entry

- Real-time spending alerts

- “Safe to Spend” daily balance indicator

Final Result

SmartBudget has been adopted by 15 universities as their official financial wellness partner.

80K Users Onboarded

Over 80,000 students have joined the platform, demonstrating a strong need and appreciation for student-focused financial tools.

45% Expense Reduction

Active users reported an average reduction of 45% in non-essential spending, showcasing the app's effectiveness in promoting budgeting.

20K Monthly Savings

Collectively, students are saving over $20,000 per month towards their goals using the app's smart features.

This project proves that financial responsibility can be engaging and accessible when designed with the user in mind.